TheProblem

Boating is Expensive

Steep Learning Curve

Finding a Consistent Crew

14

Outings a YearFor Average Boat Owner

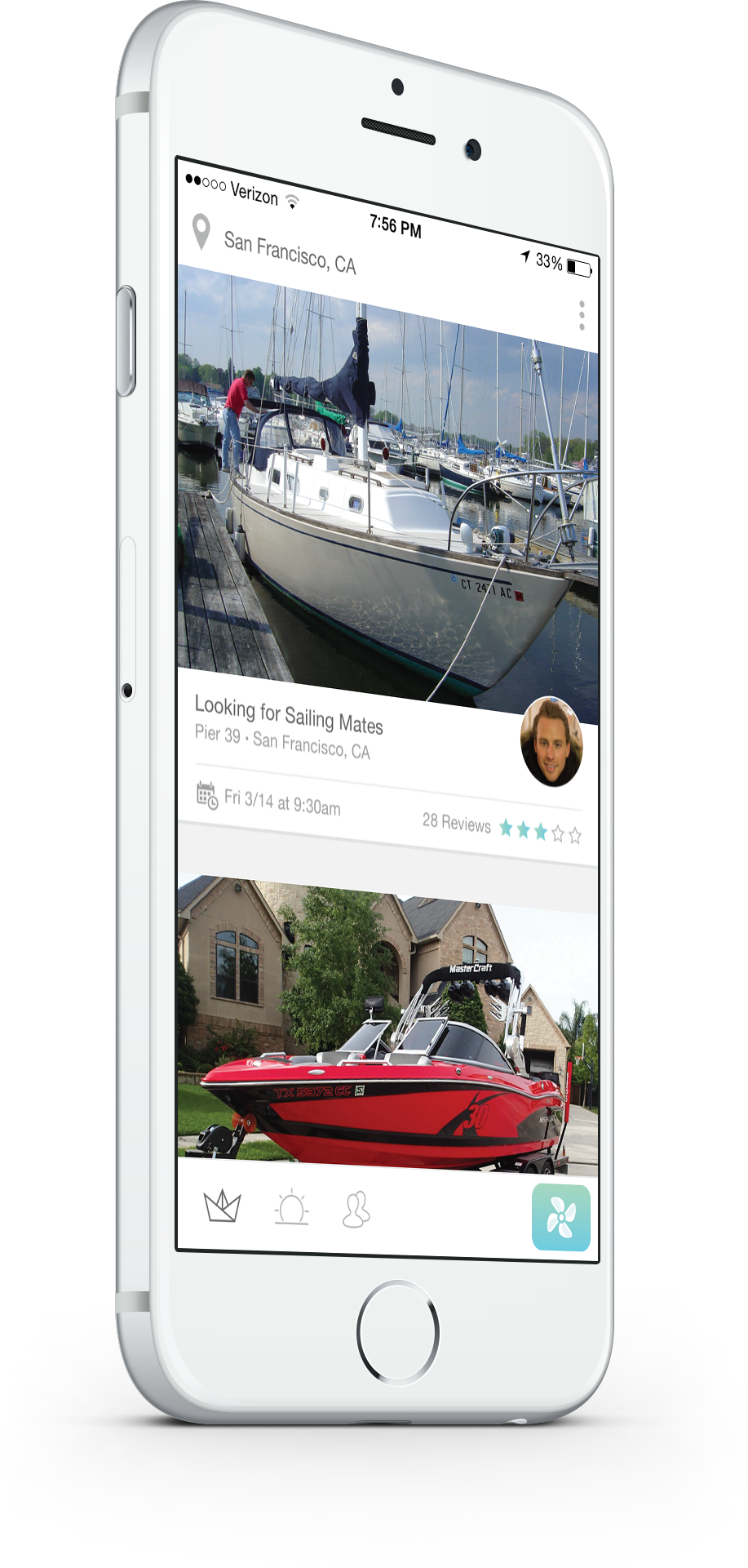

TheSolution

Share a Ride

Find a Ride

Anywhere

Current Model

Utilizing Facebook Groups

Creating Meetup Groups

Message Board Communities

Problems WithCurrent Model

- Burden On Host

- Annual Fees

- Limited Features

- Limited on Mobile

- Fragmented Market

FragmentedMarket Conditions

Supply4,740 Posts/Groups

Demand110,912 Events/Relpies

Chart represents US supply and demand

for ride-share wakeboarding in 2013 Sources = Facebook, Meetup, and 7 different message boards Supply = Groups and posts by those who want to share their boat Demand = Successful events and replies by riders to supplied boats

for ride-share wakeboarding in 2013 Sources = Facebook, Meetup, and 7 different message boards Supply = Groups and posts by those who want to share their boat Demand = Successful events and replies by riders to supplied boats

MonetizationShort-Term

- Peer to peer donation transactions

- Prop takes a percentage of donation transactions

MonetizationLong-Term

- Onboard charter boat rental business to grow supply side

- Prop charges a commission for all in-app bookings

- Revenue collected from promoting Featured Events / Rental Partners

Go-to-MarketObtain First Users

- The goal is to get evangalists on our app through the following channels...

-

Dealerships

- Boating Lifestyle

- In-app Boat Demos

-

Organizations

- Fishing

- Watersports

- Sailing

-

Third Party

- Meetup

- Message Boards

-

Existing Apps

- Wakescout

- FishBrain

- Riders App

- ReelPhoto

New StartupsBoating Platforms

| Startup | Category | Founded | Funding | Rental Locations |

|---|---|---|---|---|

| BoatBound | Peer-to-peer rentals | July 2012 | $4.5M | U.S. |

| BoatSetter | Peer-to-peer rentals, skippered yachts | August 2013 | $1.9M | U.S. |

| aBoatTime | Skippered yachts | February 2012 | $1.76M | Europe |

| GetMyBoat | Peer-to-peer, charter rentals | July 2012 | $1M | Worldwide |

| Yachitco | Skippered yachts, rentals | January 2011 | $1M | Worldwide |

| Incrediblue | Skippered yachts, rentals | March 2012 | $810K | Worldwide |

| Sailo | Peer-to-peer, charter rentals | March 2014 | - | U.S. |

| Fun2Rent | Peer-to-peer rentals for boats, trailers and jetskis | September 2012 | Raising | U.S. |

| BnbBoat | Peer-to-peer, charter rentals | 2010 | - | Worldwide |

| BoatforRent.com | Peer-to-peer, charter rentals | April 2013 | - | Worldwide |

CompetitiveAdvantage

| Social Charter | Private Charter | Mobile App | In-App Booking | Captain Services | Payment Solution | Website Portal | |

|---|---|---|---|---|---|---|---|

| Prop | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| GetMyBoat | ✓ | ✓ | ✓ | ✓ | |||

| Cruzin | ✓ | ✓ | ✓ | ✓ | |||

| Boatbound | ✓ | ✓ | ✓ | ✓ | ✓ |

TechnologyAdvantage

- Never leave the app, as all logistics involved in getting a group out on the water can be handled within the Prop app

- Crowd-funded boating experience makes getting out on the water cheaper for everybody

MeetThe Founders

-

Diego Netto

Software Engineer

Tech Author & Consultant

Founder vqTek

Diego Netto

Software Engineer

Tech Author & Consultant

Founder vqTek

-

Robert Jones

Financial Consultant

Founder IDOLoud

Founder JustBoat Rentals

Robert Jones

Financial Consultant

Founder IDOLoud

Founder JustBoat Rentals

-

Stefan Erickson

Product Designer

UX/UI Consultant

Founder Rooster Plate Creative

Stefan Erickson

Product Designer

UX/UI Consultant

Founder Rooster Plate Creative

MeetAdvisors & Partners

-

Alex Hidalgo

Community Evangelist / Captain

Founder JustBoat Rentals

Alex Hidalgo

Community Evangelist / Captain

Founder JustBoat Rentals

-

Chris Fagan

Dallas Area Investor

Founder/CEO Key Ring App

Chris Fagan

Dallas Area Investor

Founder/CEO Key Ring App

-

Josiah Toepfer

USCG Investigator/Inspector

USCG Academy

Josiah Toepfer

USCG Investigator/Inspector

USCG Academy

Experience Our Interactive Prototype

- Download the Pixate app on your iPhone or Android device

- Open Pixate, select "Scan QR Code" below the Log In

- Visit this landing page and scan the QR code

- Enjoy!